Customer lifetime value (CLV) has long been established as the key metric financial services firms use to gauge their profitability and competitive position in the market. It is also central to helping leaders develop best-practice strategies to attract and retain new customers.

Faced with rising competition from digital-first providers, financial services and banking institutions are under pressure to deliver innovative products rapidly and securely. Dynatrace’s latest research polled 300 IT leaders within financial services and banking institutions. 90% of respondents say digital transformation has accelerated in the past 12 months. Over a quarter of respondents (26%) expect it to continue to speed up in the future.

Difficult tradeoffs lead to speed, quality, and security issues

The rate of digital transformation is increasing across the sector in line with customer demand for more connected experiences. But there are differences between banking and financial services institutions with how frequently software updates are carried out. For example, just 4% of banking CIOs deploy new updates every minute compared to 18% in financial services.

This pace of change is so great that financial sector CIOs find it hard to maintain software security and reliability. Over half of CIOs (53% from banking and 62% in financial services) confirm they are forced to make trade-offs between quality, security, and user experience to meet the need for rapid transformation.

Further, over a third of IT leaders (35% in banking, and 41% in financial services) confirm they are forced to sacrifice code security. This puts sensitive customer and transactional information at risk.

Where do financial services leaders go from here?

The growing demand for rapid innovation is worsened by the ongoing skills shortages. 78% of CIOs across banking and financial services organizations confirm that a lack of skilled resources hampers their ability to keep up with demand. But it’s clear that IT leaders have other strategies in mind to tackle the challenge. Only 33% of IT professionals believe the answer lies in hiring more operations, DevOps, and SRE professionals.

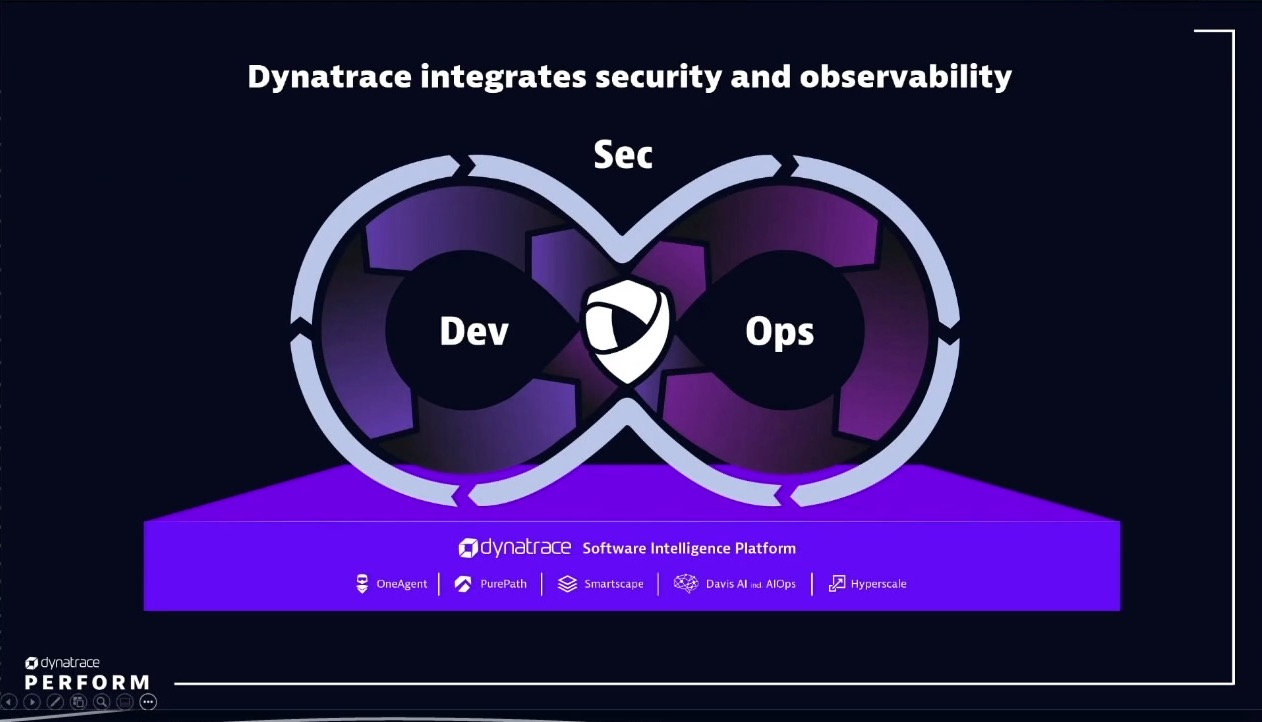

CIOs across banking and financial services overwhelmingly support a DevSecOps culture. 95% confirm that this movement will be key to accelerating digital transformation while driving faster, more secure software releases. However, this practice is not yet mature. Only 24% of IT leaders across both sectors state that most, or all, of their teams adhere to a DevSecOps culture.

The perception differs between the two financial sectors on which are the most significant barriers to adoption. 67% of CIOs in banking confirm their security teams don’t trust developers, compared to 52% in financial services. 42% of banking IT leaders believe developers see security teams as the blocker to innovation. 41% of respondents in financial services agree. Finally, siloed culture between DevOps and security teams leads to resistance in collaboration for 41% of financial services respondents. Just one-third (33%) of leaders in banking agree.

Automate and collaborate

To drive CLV, IT leaders must empower their teams to deliver faster innovation without compromising software quality or security.

With manual approaches no longer an option, CIOs are targeting investment in automation and collaboration strategies, including continuously testing software quality and security in production (59%), closely aligning Biz, Dev, Sec, and Ops teams to ensure all are working towards the same goals (32%), and AIOps-driven root cause analysis (28%).

Leaders must bridge observability and security

Across the sector, customers require immediate access to their finances. But interruptions to services caused by software issues or vulnerabilities can have a disastrous impact on CLV. IT leaders have no room for error. They must ensure their teams can access detailed contextual analysis to drive fast issue detection and resolution.

By converging observability and security on a single, AI-powered platform, financial and banking institutions can break down silos between teams. They can also collate the data required to boost CLV by accelerating innovation, delivering seamless customer journeys, and maintaining secure applications.

In fact, 88% of IT leaders across the two sectors believe increasing the use of AI and automation across DevOps and security will be key to scaling DevSecOps practices. Moreover, 89% say the convergence of observability and security will be critical to building a DevSecOps culture.

For more insight, download the complimentary ‘Insights into DevSecOps culture adoption in Financial Services organizations’ infographic.

Learn how Dynatrace can help you build and mature a successful DevSecOps culture so you can deliver reliable and resilient software at the speed your business demands.

Looking for answers?

Start a new discussion or ask for help in our Q&A forum.

Go to forum